The Limits Of Current Capability In The World Of Portfolio Optimization

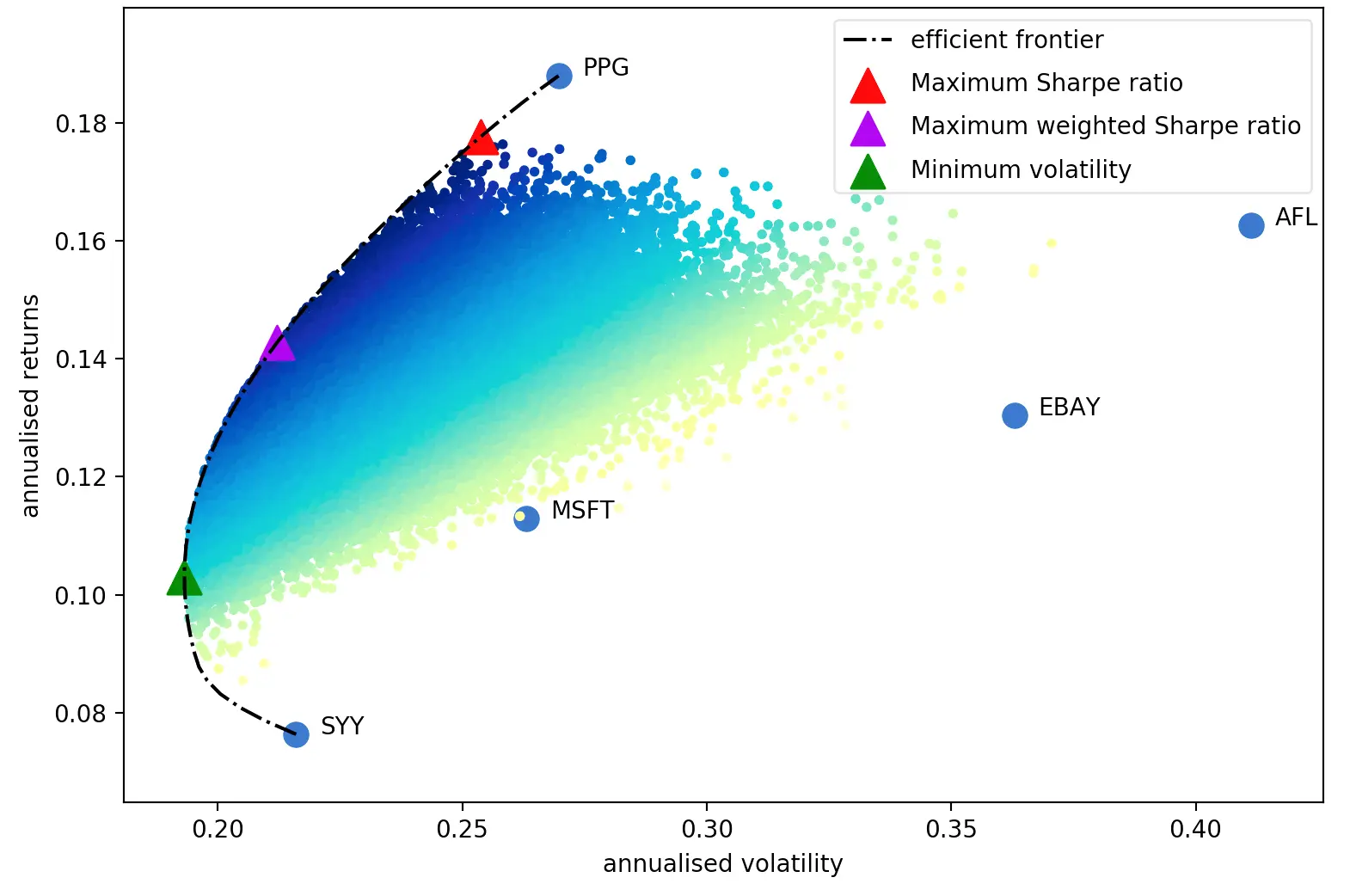

Portfolio Optimization using Sharpe Ratio Maximization (Maximizing Returns and Minimizing Risks) is phenomenally Data and Compute Intensive.

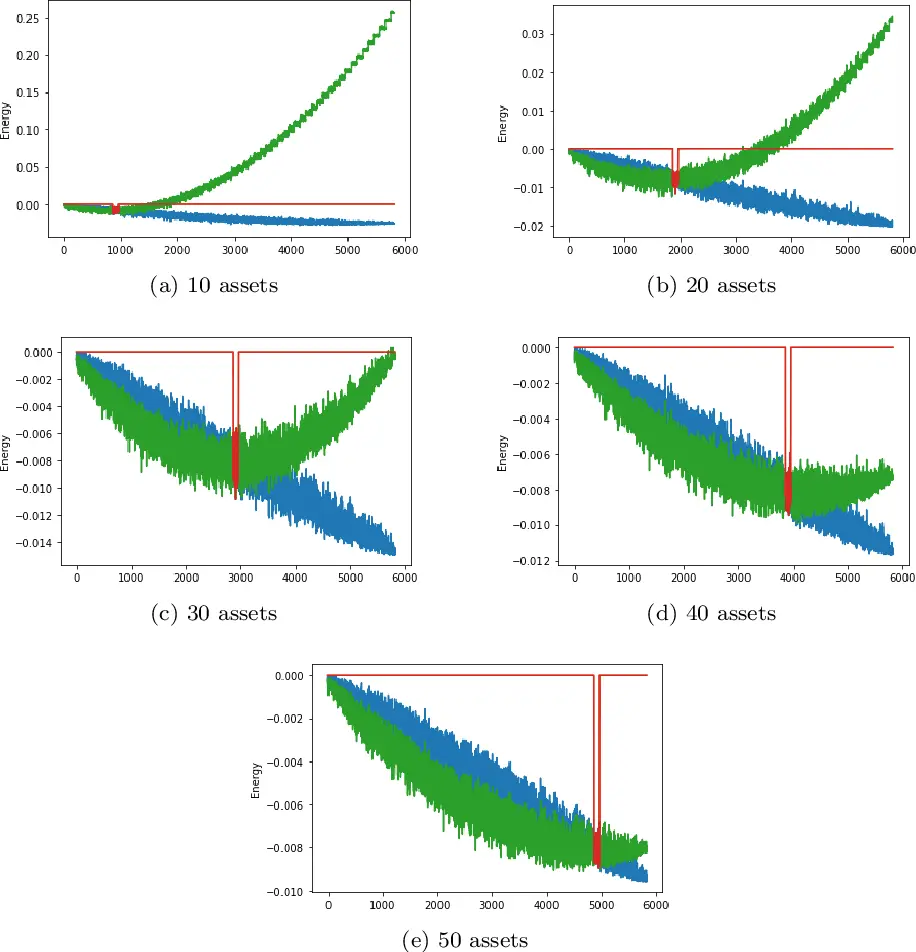

All Quantum Algorithms implemented till date top at about 50-60 Asset Portfolios. Some claim ~100.

All Classical Solvers like Gurobi etc. top at about ~300 Assets

Engineers try to use Hierarchical Algorithms and other Heuristics/Tricks.

Automatski has a Hybrid Algorithm which in a Production Deployment can do Portfolio Optimization w/ 100,000+ Assets. Which is basically equivalent to everything in the New York Stock Exchange.